In today’s rapidly evolving financial landscape, understanding the interplay between economic shifts and cryptocurrency investment strategies is crucial for savvy investors. With economic trends influencing Bitcoin’s attractiveness and potential regulatory frameworks emerging, there’s a considerable opportunity for investment growth amidst these changes.

Navigating Economic Trends Affecting Cryptocurrency Investments

Economic shifts have a direct impact on investor confidence in cryptocurrencies. Factors such as inflation rates, unemployment rates, and interest rates all shape the landscape of asset investments, especially in the world of cryptocurrency. For instance, periods of economic uncertainty often correlate with increased interest in Bitcoin as a store of value, appealing to investors looking to hedge against inflation. According to recent analysis, as traditional asset classes fluctuate, Bitcoin often experiences a surge in investment interest, further emphasizing this relationship.

Several key indicators signal changes in the cryptocurrency investment landscape. The Consumer Price Index (CPI) and Gross Domestic Product (GDP) reports play pivotal roles in shaping market sentiment. For example, a declining CPI can indicate a cooling economy, which might prompt investors to seek refuge in cryptocurrencies. Market sentiment is similarly vital; as enthusiasm around Bitcoin rises, driven by favorable economic indicators or news, investments are likely to follow suit. Thus, understanding these economic trends is essential for anyone looking to navigate Bitcoin investment strategies effectively.

The Role of Crypto Regulation in Shaping Investor Choices

Recent regulatory developments have profound implications for cryptocurrency markets and investor behavior. For instance, as the Crypto Market Structure Bill progresses through legislative bodies, it promises to provide clarity that could attract traditional investors. Regulatory frameworks can bolster investor confidence, but they can also lead to uncertainty; as regulations evolve, so too does investor perception.

Moreover, stricter regulations can present both challenges and opportunities. Regulation aims to prevent fraudulent activities within cryptocurrency markets, but it can also restrict the operational capabilities of many digital asset platforms. The challenge lies in finding a balance that protects investors while allowing innovation to thrive within the sector.

Bitcoin Investment Strategies Amidst Current Market Fluctuations

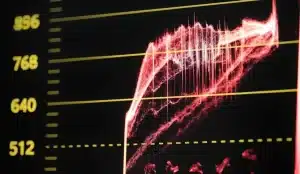

Current market conditions highlight the importance of adaptive Bitcoin investment strategies. Bitcoin prices have shown volatility, with fluctuations creating both risk and opportunity for investors. As of now, BTC is hovering around 28% below its all-time high of $126,275, presenting a potential buying opportunity for investors believing in the long-term value of cryptocurrency.

Investors must align their strategies with recent economic and market trends to maximize returns. Utilizing tools like technical analysis to study price patterns can provide insights into future movements. Additionally, dollar-cost averaging is a method some investors employ to mitigate risk by investing fixed amounts over regular intervals, regardless of price volatility. By doing so, they attain a balanced entry point without attempting to time the market perfectly.

Understanding Stablecoins and Their Impact on Bitcoin Valuation

Stablecoins play a crucial role in the cryptocurrency market by providing a reliable foundation for transactions and value storage. Unlike Bitcoin, which is subject to high volatility, stablecoins are pegged to stable assets, such as the US dollar. This characteristic is particularly significant during periods of market fluctuations, as stablecoins offer a cushion against abrupt price swings while allowing investors to engage with Bitcoin indirectly.

The adoption of stablecoins can significantly impact Bitcoin investment patterns. As more cryptocurrency users turn to stablecoins for transactions, their value can directly influence Bitcoin pricing dynamics. Moreover, stablecoins can facilitate smoother exchanges and reduce the risks associated with market volatility, enhancing a sense of security for Bitcoin investors in turbulent economic times.

Financial Innovation as a Catalyst for Cryptocurrency Growth

Technological advancements are driving the growth of the cryptocurrency market and reshaping investment opportunities. Innovations like decentralized finance (DeFi) platforms enable investors to lend and borrow cryptocurrencies efficiently, generating new revenue streams. This evolution also aligns with broader economic conditions, as individuals increasingly seek alternative methods for financial growth amid traditional market uncertainties.

Furthermore, emerging financial products tailored to cryptocurrencies, such as exchange-traded funds (ETFs) and futures contracts, draw new investors into the market. By providing mainstream access to digital assets, these innovations catalyze institutional investment and can foster greater legitimacy for cryptocurrencies as viable assets in diverse portfolios.

Actionable Steps for Investors in the Cryptocurrency Space

To thrive in the evolving cryptocurrency landscape, investors should adopt practical strategies to adapt to market shifts. Staying informed about technological developments, regulatory changes, and economic trends is paramount. Utilization of analytics tools and platforms can enhance investment strategies, allowing for informed decision-making based on real-time data.

Additionally, it’s crucial for investors to maintain a diversified portfolio, balancing investments in both cryptocurrencies like Bitcoin and traditional assets. By doing so, they can mitigate the risks associated with cryptocurrency market volatility.

An informed and proactive approach is essential for navigating the complexities of economic shifts affecting Bitcoin. As the cryptocurrency sector continues to develop, ongoing education and strategic planning will empower investors to seize the myriad opportunities that arise.